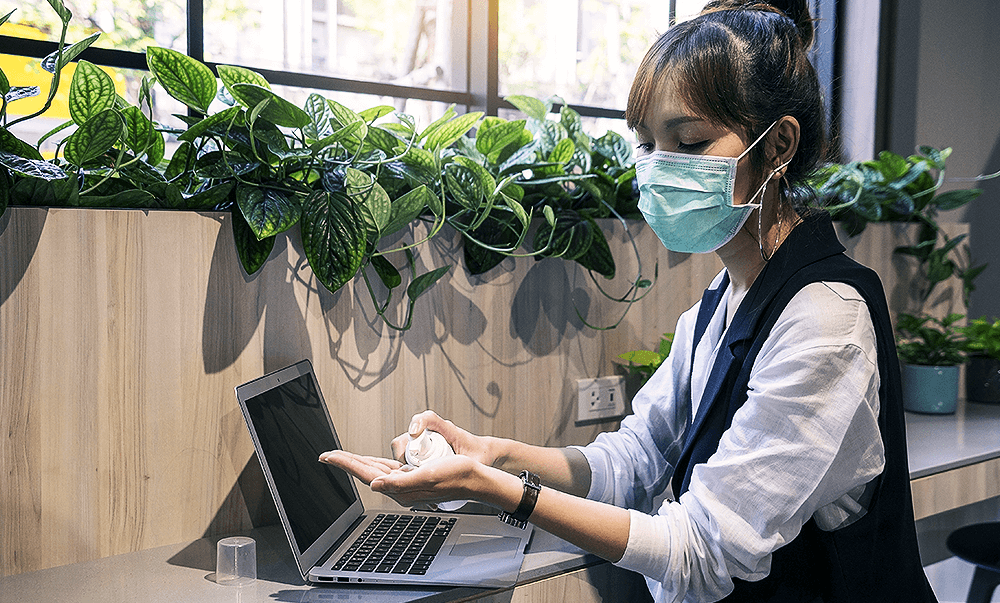

Do you feel overwhelmed and stressed by your financial situation? You’re not alone. While we know work-related stress and burnout is becoming more prevalent, financial stress is also on the rise. One survey suggests it is the number one cause of stress for nearly half of all Americans.

Financial stress often comes with embarrassment or lowered self-esteem that makes it challenging to address. When we tie self-worth to financial value, every little financial hiccup feels like a blow.

But these are problems that won’t go away on their own, so here are four steps to stop letting financial stress hold you down and start taking back control instead.

.

– 4 tips to stop worring and start doing! –

1. Approach it with calm and clarity.

2. Lead from the present moment.

“DON’T GET CAUGHT UP IN THE IDEA THAT THIS IS A ‘FOREVER’ SITUATION. FIGURE OUT WHAT YOU CAN CHANGE RIGHT NOW AND START TAKING STEPS TOWARDS IT. “

3. Accept the reality.

4. Don’t hide it.

by DOLCE LIBERTA. More than a Bikini!

_________________________________________________________________________________________________________

Feature article: 8 Swimsuit Mistakes. Are you doing some of them? Now that you know, it’s your choice to change!

__________________________________________________________________________________________________________

Nicolas Roy

Duis congue leo magna, id molestie mauris mollis laoreet. Duis pulvinar libero in tellus suscipit, id porttitor magna luctus.